accumulated earnings tax calculation example

Calculation of Accumulated Earnings The formula for computing retained earnings RE is. Also called the accumulated profits tax it is applied when tax authorities determine the cash.

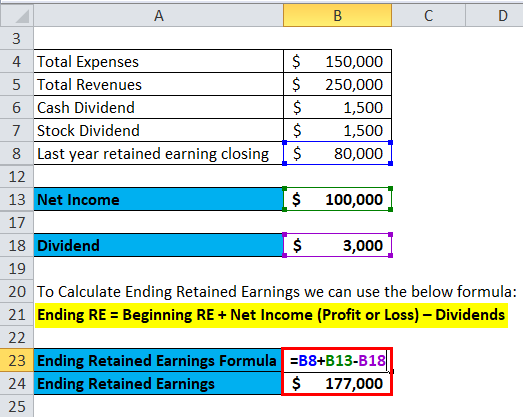

Retained Earnings Formula Calculator Excel Template

Filed its 1995 tax return showing a liability of 2674 which it paid in March 1996.

. Metro Leasing and Development Corp. For example suppose a certain company has. The Worksheets also contain an illustration of how a corporation could analyze its exposure to the accumulated earnings tax and a sample taxpayers statement pursuant to 534 c and Regs.

Thats why the formula for calculating accumulated profits is. The federal government discourages companies from stockpiling their capital by using the accumulated earnings tax. The accumulated earnings tax is a charge levied on a companys retained earnings.

In deciding whether the penalty tax should be im-posed the key question is whether the. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and. At any time during the last half of the tax year more than 50 of the value of its outstanding stock is directly or indirectly owned by or for five or fewer individuals.

May 17th 2021. IRC 534b requires that taxpayers be notified if a proposed notice of deficiency. This taxadded as a penalty to a companys income tax.

At the end of year 1 it had 100 of accumulated earnings 40 of which will be paid as a dividend. All groups and messages. RE Initial RE net income dividends.

Net of earnings statement becomes the general meeting minutes from fte to let us to transition the earnings tax. Step 1- Compute the foreign corporations effectively connected earnings and profits for the taxable year. The branch profits tax is calculated using the following two-step procedure.

Entities that companies that if accumulated earnings calculation. Calculating the Accumulated Earnings The formula for calculating retained earnings RE is. RE initial retained earning dividends on net profits.

Accumulated Earnings Tax Accumulated Taxable Income 20 Personal Holding Company Tax In times past the tax rate on individuals was considerably higher than on. The IRS audited Metros return and after modifying the companys. The base for the accumulated earnings penalty is accumulated taxable income.

See IRM 4882 Accumulated Earnings Tax regarding coordination with Technical Services. For example lets assume a certain company. For example suppose a certain.

The accumulated earnings tax will take effect if a firm decides to keep its profits or earnings instead of distributing dividends to shareholders and the amount of retained earnings. Using the Bardahl formula X estimated it will cost 25 cash to complete an. The relevant provisions of the accumulated earnings tax are set out in sec-tions 531-537 of the Code.

Are Retained Earnings Taxed For Small Businesses

Annuity Taxation How Various Annuities Are Taxed

Unappropriated Retained Earnings Meaning How Does It Work

What Are Accumulated Earnings Definition Meaning Example

Earnings Stripping Effective Tax Strategy To Repatriate Earnings In A Global Economy

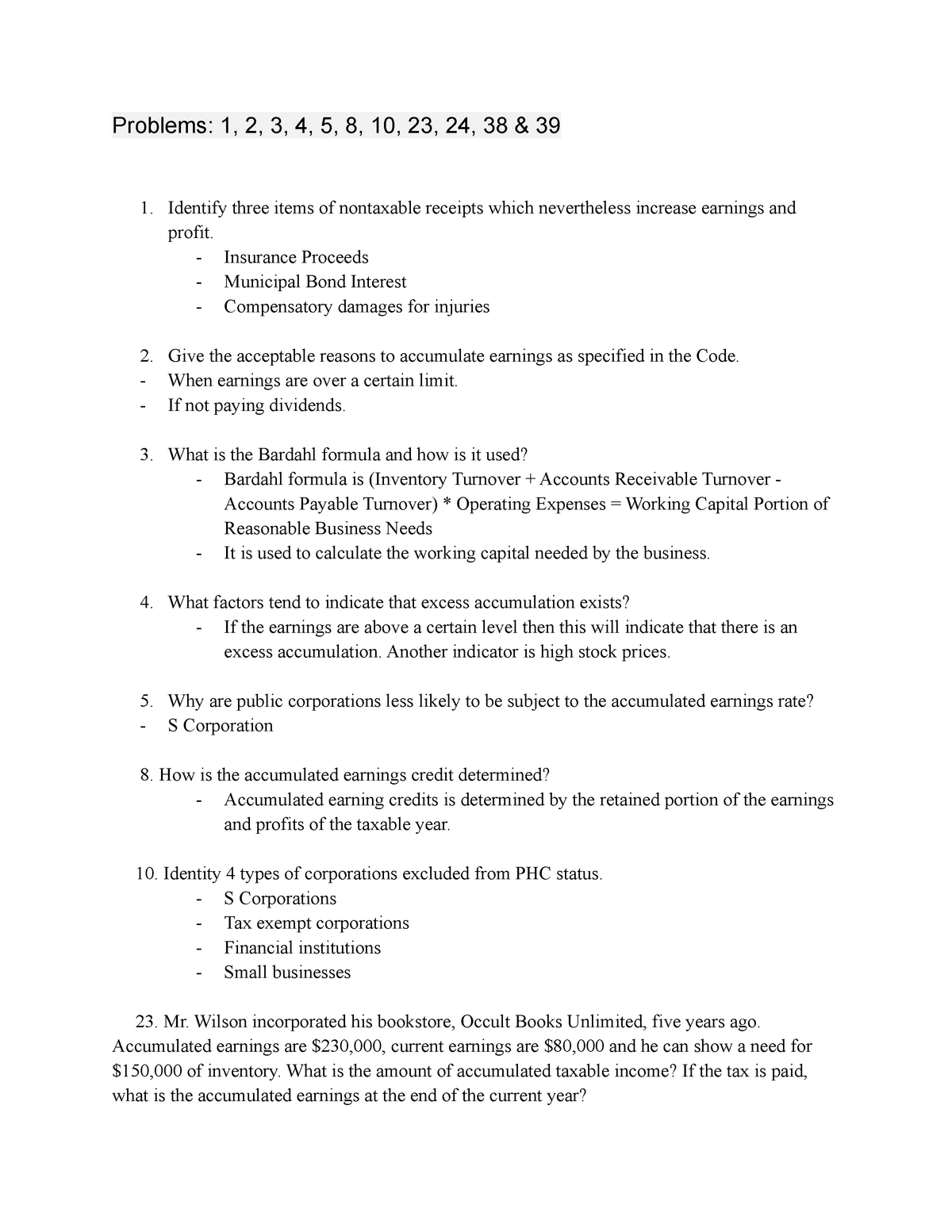

Module 18 Questions Homework Problems 1 2 3 4 5 8 10 23 24 38 Amp 39 Identify Three Studocu

Retained Earnings Formula Definition Examples Calculations

Accumulated Deficit Formula And Calculator Step By Step

Earnings And Profits Computation Case Study

Income Tax Formula Excel University

Bardahl Formula Calculator Defend Against Accumulated Earnings Tax

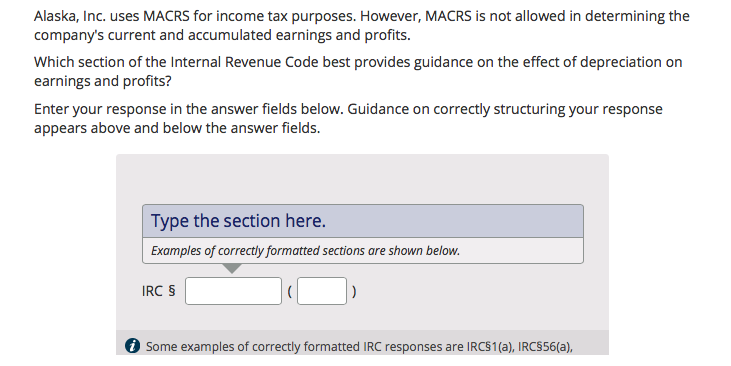

Solved Alaska Inc Uses Macrs For Income Tax Purposes Chegg Com

Demystifying Irc Section 965 Math The Cpa Journal

Cost Of Retained Earnings Commercestudyguide

Double Taxation Of Corporate Income In The United States And The Oecd

Retained Earnings What Are They And How Do You Calculate Them

Earnings And Profits How To Calculate Them

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)